August 19, 2024

Finance

DOL regulation that took effect July 1 will impact employees newly eligible for time and a half as well as those who are not.

April 16, 2024

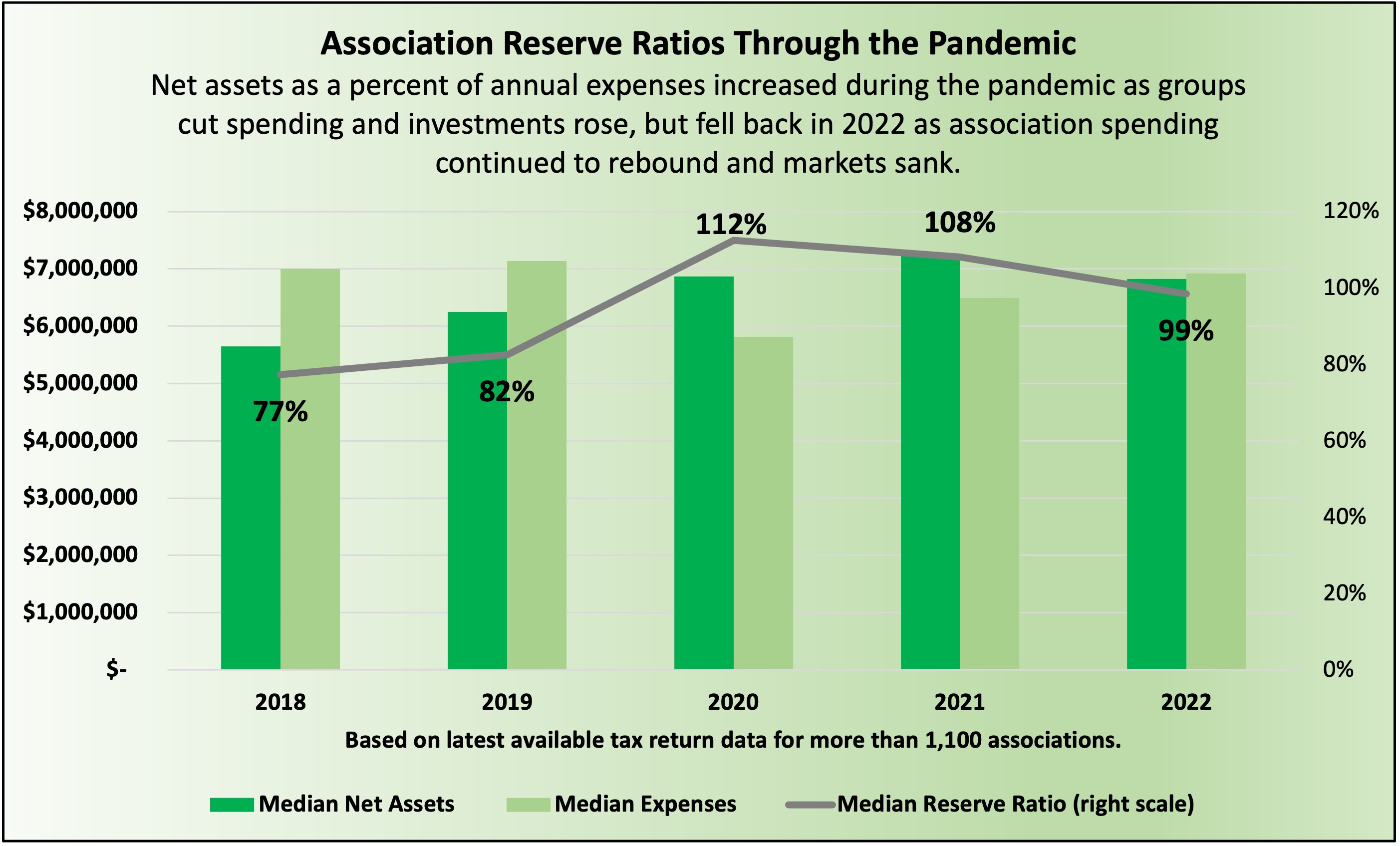

Investments boosted the median association reserve ratio in 2020-2021

April 15, 2024

The appropriate size for association reserve portfolios hinges on factors like stability of revenue, potential litigation and advocacy costs.

April 11, 2024

Focus on building relationships and commitment to association’s mission; first-time CEOs should concentrate on proving themselves.

October 10, 2023

There’s no need to wait until the last year of your deal to seek an extension; candidates who get offers can take cues from recruiters.

April 4, 2023

In uncertain times, strong investment approach is essential for nonprofits; volunteers should stay within bounds, avoid personal bias.

October 17, 2022

The unusually steep decline of both stocks and bonds could have an impact on future association initiatives.

August 19, 2022

Top finance executives support programs, look ahead for opportunities

Difference between calendar and fiscal years can create confusion, cloud financial picture